Govt Abstract

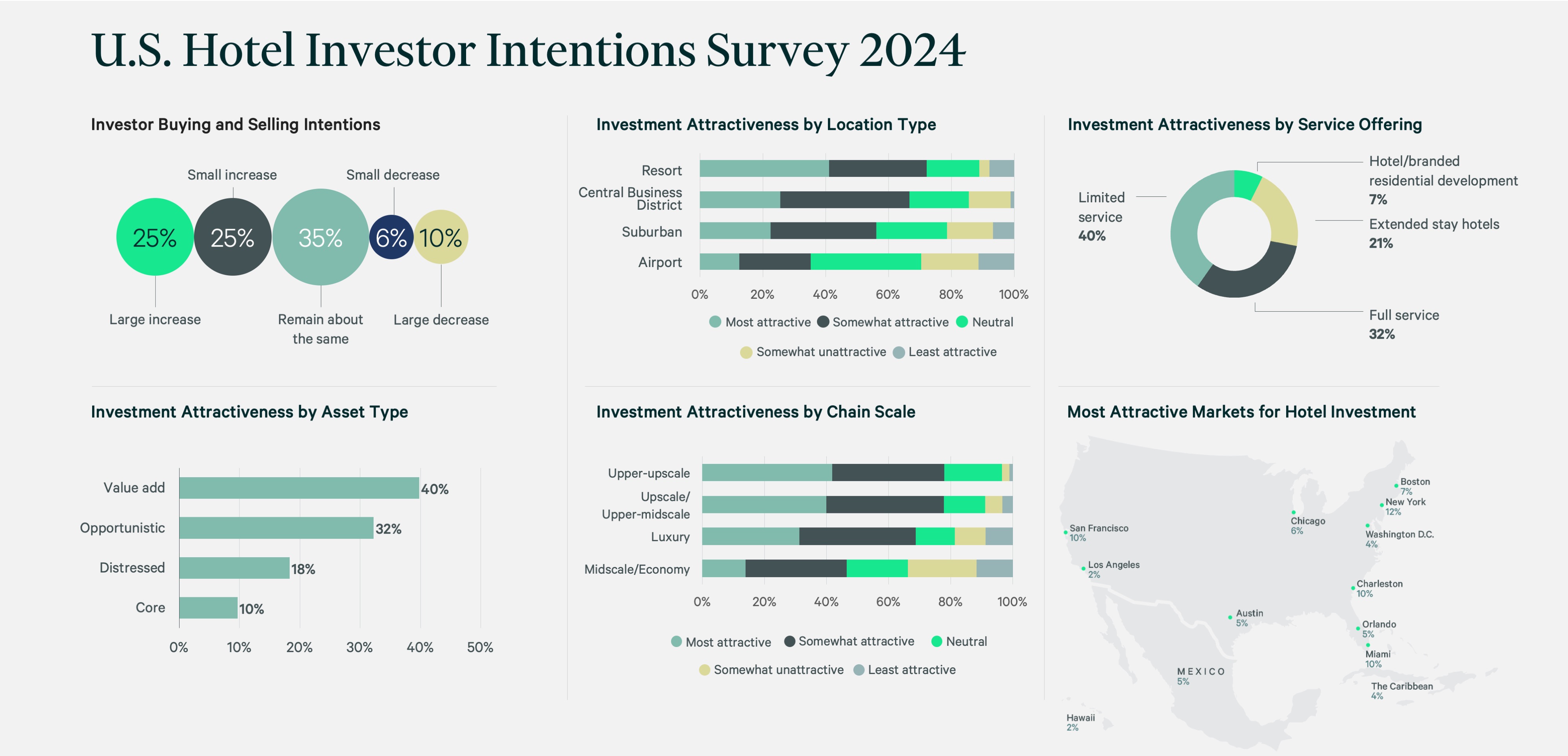

- U.S. traders have usually optimistic sentiment concerning the lodge market this yr, with half of these surveyed planning to extend their lodge investments in anticipation of upper whole returns and decrease costs. Strengthening the stability sheet and problem in securing and servicing debt are the highest challenges for many who plan to purchase much less this yr.

- Central enterprise districts (CBDs) and resorts are probably the most favored location sorts, whereas upper-upscale and upscale/upper-midscale are the most well-liked chain-scale targets in 2024. We count on RevPAR progress of three.1% for city places from elevated group, enterprise and worldwide journey. We additionally count on that regular leisure demand and modest ADR beneficial properties will assist 1.6% RevPAR progress for resort places.

- Elevated borrowing prices and labor bills are the largest challenges for lodge funding this yr, adopted by larger insurance coverage prices. These prices probably will decrease margins. Whereas we count on conventional lodge demand and pricing could also be tempered by competitors from different sources like cruise strains, short-term leases and out of doors lodging, solely 30% of these surveyed contemplate this a problem.

- Main city markets like New York and Washington, D.C. are anticipated to have the strongest lodge market fundamentals in 2024, together with leisure-focused places like Miami, Charleston and Austin. Given restricted new lodge provide and restrictions on short-term leases, New York Metropolis is 2024’s most tasty funding market, adopted by Miami, Charleston and Boston. Maybe as a result of extra distressed belongings might enter the market and make pricing extra favorable, traders indicated curiosity in San Francisco—a market that has lagged in restoration because the pandemic.

Half of traders count on to extend their investments in accommodations in 2024.

CBRE Motels Analysis carried out a World Lodge Investor Intentions Survey in early 2024 to evaluate the local weather for lodge funding. Within the U.S., lodge investor sentiment seems sturdy, with half of the respondents indicating that their allocation to lodge acquisitions would improve. Roughly 35% of respondents count on acquisition exercise to stay the identical as in 2023, whereas lower than 16% count on it to lower.

Learn the total report right here.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 firm headquartered in Dallas, is the world’s largest business actual property companies and funding agency (primarily based on 2021 income). The corporate has greater than 105,000 staff (excluding Turner & Townsend staff) serving purchasers in additional than 100 nations. CBRE serves a various vary of purchasers with an built-in suite of companies, together with amenities, transaction and challenge administration; property administration; funding administration; appraisal and valuation; property leasing; strategic consulting; property gross sales; mortgage companies and improvement companies. Please go to our web site at www.cbre.com.

Robert Mandelbaum

Director of Analysis Info Companies

CBRE Motels