5 predictions for 2025

The yr forward appears set to be a pivotal one for business actual property. Whereas efficiency is asynchronous throughout geographies and markets – and throughout asset sorts inside markets – on stability we imagine the actual property cycle has turned a nook.

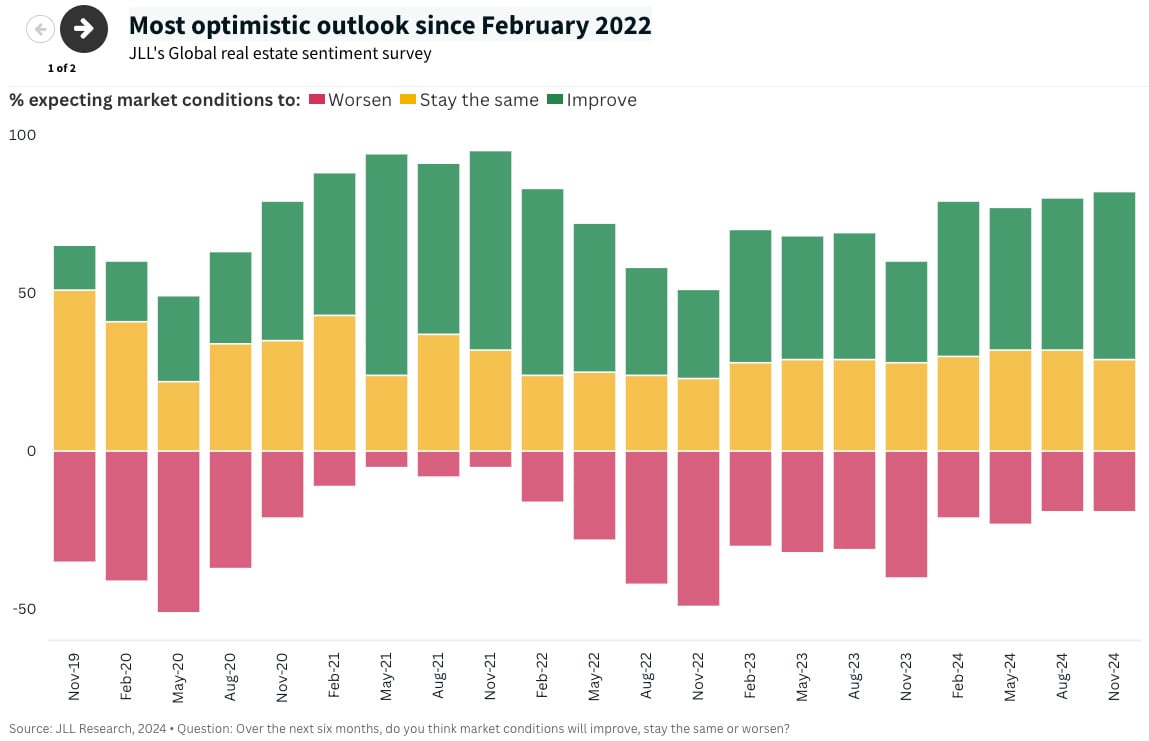

Our latest World Actual Property Sentiment survey is indicative of this shift. As of November 2024, we noticed the strongest end in practically three years. A majority of respondents are indicating they assume circumstances will enhance additional over the following six months.

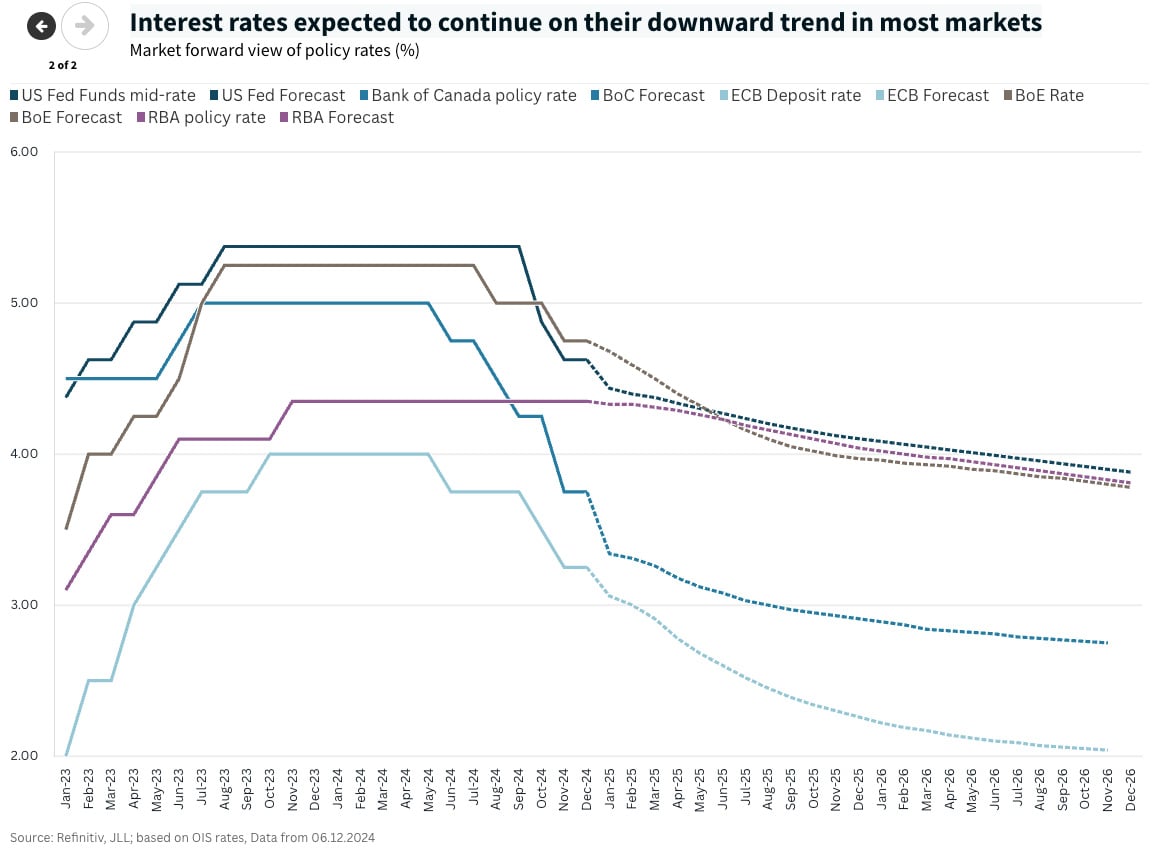

That’s to not say that 2025 will probably be a straightforward yr. We’re prone to see an unsettling degree of uncertainty: financial, regulatory, fiscal and commerce insurance policies will proceed to alter and take form, and we will probably be watching these intently. Rates of interest in most markets will proceed on their downward trajectory, however expectations for the pace and magnitude of change have confirmed extremely dynamic and we anticipate to see indicators of continued volatility. Occasions can supersede plans at any level and alter rate-setters’ anticipated selections. And that is to say nothing of the continuing and potential geopolitical conflicts all over the world.

We predict alternatives will probably be plentiful within the coming yr, however to thrive in 2025, actual property members might want to perceive the main points and nuances on the market, asset and house ranges along with the secular tendencies. This rising tide might not carry all boats, so it will likely be essential to choose the appropriate actual property, not simply choose the index.

1. Provide shortages will worsen for in-demand property throughout property sorts in 2025

A decline in new provide will affect virtually all business actual property sectors within the U.S. and Europe. Broadly talking, new constructing exercise has dropped off amid continued excessive development and financing prices and labor market constraints.

Nowhere is the decline in completions as excessive as within the U.S., the place we forecast places of work will see a 73% drop from peak ranges (most notable in cities like Boston, Chicago and New York) and industrial property a 56% decline. In Europe, there will probably be a 30% drop-off in new workplace completions with competitors for prime house prone to be notably robust in cities together with London, Madrid and Warsaw. We anticipate related or bigger declines in new industrial house in Germany and the UK. The Asia Pacific area is an outlier, pushed by extra favorable development and demand circumstances. Solely industrial house deliveries will see a slight decline from peak ranges.

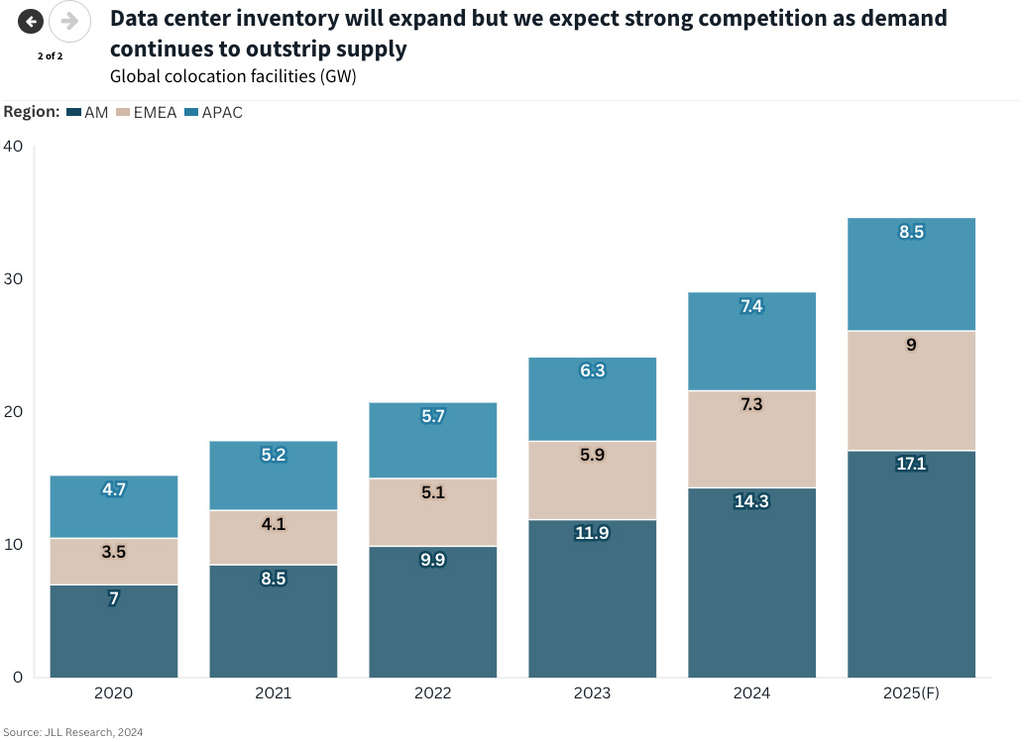

Knowledge facilities are additionally experiencing vital provide shortages in lots of markets all over the world, with extraordinarily excessive demand exceeding strong provide development. Completions in 2025 are forecast to be above the 2021-24 peak throughout all three areas, with the most important proportion development in markets together with Atlanta, Portland and Phoenix within the U.S.; Madrid, Milan and Scandinavia in Europe; the Center East area and Malaysia, Mumbai and Seoul in Asia Pacific. And but shortages will nonetheless exist – such is the rising demand for knowledge facilities, boosted by AI necessities, that even this improve in provide will probably be solely a fraction of what the market wants.

For Europe and the U.S., there are a number of implications from the broad-based slowing in new provide. Firstly, regardless of general excessive emptiness in some property sorts, there will probably be a extreme lack of high-quality obtainable house choices for workplace occupiers trying to increase or relocate into the highest section of the market. This can contribute to a better share of renewals on lease expiry and require extra proactive portfolio administration. On this distinctive market cycle, tenants might want to plan forward, get sensible on choices and prices, be artistic and have a back-up plan.

Second, intensifying competitors for top-quality house in the very best areas will result in a better give attention to redevelopment and retrofitting and stronger demand for rising sizzling spots and next-tier property. Provide constraints in European CBDs, as evidenced by emptiness charges of simply 2.8% in Paris CBD and 1.5% for brand spanking new provide in London, are main occupiers to look in well-connected, CBD-adjacent sub-markets. And within the U.S., renovated buildings are absorbing greater than 30% of occupancy beneficial properties, up by greater than half in comparison with simply two years in the past.

For buyers, one other important implication would be the significance of understanding provide and demand dynamics in better element. With rates of interest and financing prices unlikely to return to 2021 lows, efficiency will probably be extra decided by asset, market and sector choice and lively administration to drive earnings development.

2. For buyers, the early-mover benefit might peak in 2025

In line with our analysis, business actual property investments have an extended monitor report of outperforming on returns and including stability and diversification to general funding portfolios. Over the past cycle, among the highest five-year returns had been achieved with investments transacted between 2009 and 2011, within the rapid aftermath of the World Monetary Disaster (GFC). Actually, CRE property have outperformed most different asset courses over each five-year horizon since 1998 and, even throughout the GFC, buyers with a five-year maintain interval in mixture noticed optimistic returns.

As we go away the dislocation of the tip of the final cycle behind us and look towards the upswing, buyers deploying capital in 2025 are prone to see an early-mover benefit when it comes to returns that may diminish because the cycle matures. Intensifying provide shortages as completions gradual in 2025 will amplify competitors for high quality current property as extra buyers re-enter the market.

We’re already seeing indicators of a brand new liquidity cycle. Extra capital is displaying as much as the desk and bidding on alternatives, and institutional buyers are returning to the market with a renewed urge for food for actual property. In final yr’s outlook we famous the difficult stability of protection and offense because the market tried to search out its footing. Now, the concern of constructing a mistake is being overtaken by the concern of lacking out.

The implications for capital markets have gotten clearer. Over the following yr, the bid-ask hole will proceed to slender as we see extra transactional exercise and market circumstances regular; falling coverage rates of interest will assist additional stabilize the prices of debt and help renewed development in debt origination volumes; yield compression will proceed for in-favor sectors, together with residing, logistics and choose various asset courses.

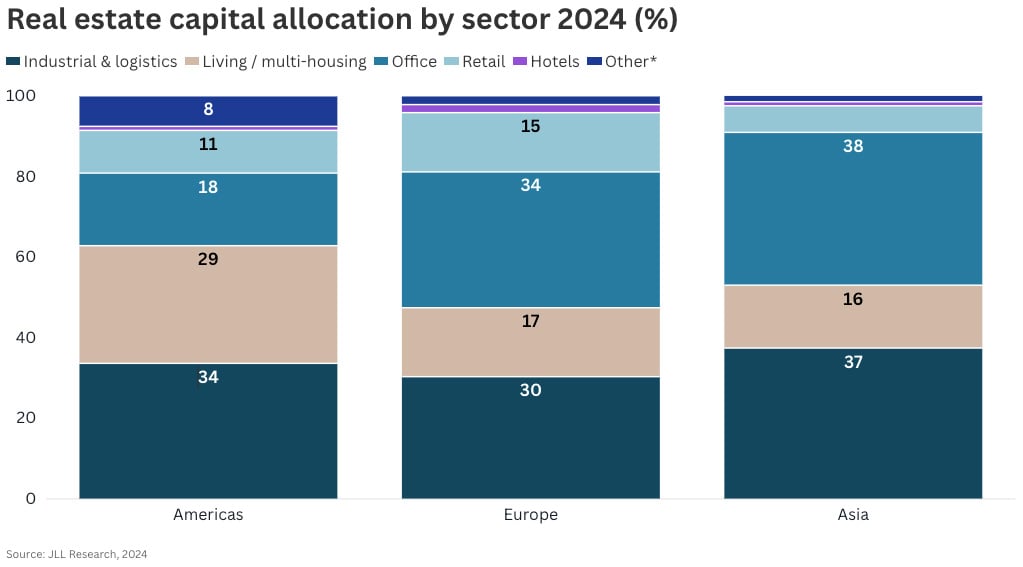

We anticipate demand for knowledge facilities to develop in Europe and Asia Pacific, as a result of dramatic rise in knowledge consumption, and to stay robust within the U.S. – the world’s largest knowledge heart market. Core residing methods will see US$1.4 trillion invested globally over the following 5 years with robust momentum within the U.S., UK, Germany and Japan, and conviction rising in some much less mature markets. Nearshoring is prone to enhance momentum within the logistics and industrial sectors, notably within the U.S., and there will probably be compelling alternatives for buyers within the workplace sector throughout all three areas, with the highest-quality workplace property in essentially the most in-demand areas main the best way as tenant demand will increase.

3. Rising company confidence in portfolio necessities will speed up decision-making

After a number of years of lowering house necessities, portfolio enlargement is again on the playing cards.

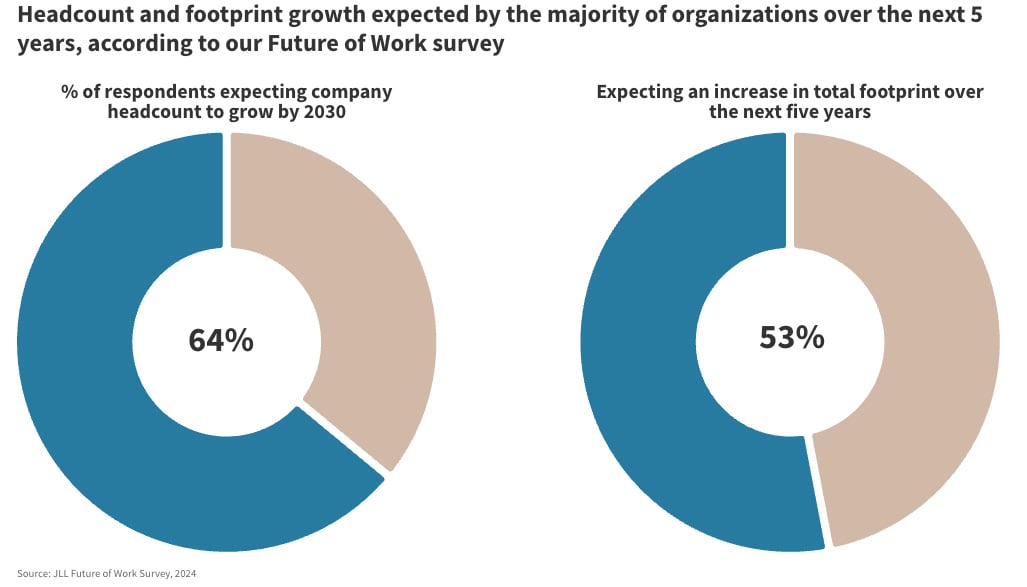

Latest bulletins from high-profile world companies point out a development towards mandating elevated workplace presence, with some requiring as much as 5 days every week and implementing attendance monitoring measures. We predict workplace attendance insurance policies will proceed shifting towards a median of 4 days per week. Getting there means extra space will probably be required: 57% of our survey respondents, each the ‘office-only advocates’ and the ‘hybrid promoters’, cited expansionary exercise as a prime expectation from 2025 by way of 2030.

Nevertheless, within the brief time period, the main target will probably be on portfolio rightsizing and remodeling areas into fit-for-purpose workplaces. For now no less than, many organizations have some extent of certainty across the hybrid/in-workplace cut up and are ready to make actual property selections. Consequently, we anticipate extra CRE leaders to begin executing on their methods after a interval of hiatus. This will imply transferring to new house or reconfiguring and redesigning current house to raised meet workforce necessities and enterprise expectations. For organizations looking for new house, selections made in 2025 might want to have a level of built-in flexibility to permit for future enlargement in years to come back.

With much less new house coming to the market and availability concentrated in much less fascinating buildings and areas, competitors for the very best house will proceed to accentuate. Corporations have to affirm their technique across the form of house they’re in search of and be proactive to safe it. This implies extra spending on workplace design, worker experiences and hospitality providers. CBD areas, vibrant mixed-use neighborhoods, buildings with main sustainability and inexperienced credentials and ‘vacation spot workplaces’ that may assist entice and retain expertise will probably be in highest demand.

4. A number of converging elements will encourage motion to mitigate danger of obsolescence

There’s a lot better focus now on the dimensions of doubtless out of date property throughout the actual property spectrum, because of shifting preferences for a way house is used, altering patterns of city growth and tightening sustainability necessities. Constructing age and design, location and ESG issues are the important thing elements actual property homeowners ought to consider when making strategic selections about their property.

By our estimation, between 322 to 425 million sq. meters of current workplace house in 66 key markets globally is prone to require substantial capital expenditure over the following 5 years – probably US$933 billion to US$1.2 trillion – to stay viable. Stranding danger is much from evenly distributed: 44% of projected obsolescence is prone to come up within the U.S. given increased ranges of structural emptiness, with an extra 34% in Europe as flight to high quality in choose segments of the workplace market results in a smaller however nonetheless important quantity of vacant product with little demand chasing it.

The complete potential to create worth can solely be achieved by way of collaborative engagement between stakeholders and planning that accounts for a way a number of kinds and ranges of obsolescence work together. This will probably be notably acute in cities the place new sustainability laws is carried out starting in 2025 and as 2030-2035 metropolis and nationwide net-zero targets method.

Continued flight to high quality and reshuffling of workplace customers into top-quality house will start to open up ample repositioning and retrofitting alternatives for actual property homeowners in 2025 and 2026. On the similar time, housing and lodging shortfalls will additional push metropolis authorities to speed up development and revise land use insurance policies, which is able to allow extra conversion of getting old workplace property to residential and lodge use. We anticipate this course of will speed up in 2025 however nonetheless take time to play out over the following a number of years as a result of complexity of navigating the bodily, capital and regulatory challenges.

5. Tackling price pressures and power safety will drive an acceleration in decarbonization efforts

Decarbonization efforts are more and more being built-in into broader actual property methods as a type of attaining operational excellence. It is because the capex invested in optimizing power use and lowering emissions in buildings ends in decrease operational prices, safe power, regulatory resilience and improved worker attraction. This evolution will rework the idea of decarbonization from solely an ESG consideration to a vital part of operational – and danger – administration, in addition to a strategic financial alternative.

Electrical energy demand is projected to rise in 2025 at its quickest tempo for twenty years (based on the IEA), partially as a consequence of AI applied sciences, EVs and the electrification of buildings, elevating issues about electrical energy prices and safety of provide. Vitality use is the one largest working expense in workplace buildings, representing roughly one-third of typical working prices. Gentle to medium retrofits can unlock between 10% and 40% in power financial savings. For workplace properties, mild retrofits save about US$4-$5 per sqm in power prices, whereas a retrofit on the mechanical, electrical and plumbing (or MEP) tools of the identical constructing can ship roughly US$17 per sqm – with even additional financial savings doable with the assistance of AI-powered tech to constantly optimize efficiency.

Financial savings range throughout asset sorts given differing power depth of operations and makes use of throughout property sectors, in addition to throughout markets as a consequence of variations in power costs. As a result of sectors like healthcare, labs and knowledge facilities are sometimes 2 to five occasions extra power intensive than places of work, even better price financial savings could be achieved. For instance, financial savings on MEP tools could be within the area of US$118 per sqm for knowledge facilities and round US$50 per sqm for labs and healthcare.

Organizations’ 2025 precedence ought to be complete power audits and feasibility research to determine the retrofit alternatives with the best potential returns, then to place these into follow. These will serve each the CFO’s goal of slicing working prices and the Board’s goal of attaining its local weather targets on the street to web zero.

Restoration, danger and resilience will probably be key themes for 2025

We imagine the approaching yr will probably be characterised by strengthening demand, improved liquidity and extra decisive company motion. The subsequent stage of the restoration cycle is underway. Whereas the general outlook is optimistic, important dangers persist, together with monetary and coverage uncertainties, provide chain disruptions, obsolescence and issues over power prices and safety. With these potential challenges in thoughts, agility and resilience will proceed to be vital for achievement. As extra market members, each buyers and occupiers, shift their stability from protection to offense to reap the benefits of the market alternatives, these in a position to reply at pace to the sudden will fare greatest.

Efficiency will range throughout geographies and property sorts, and in some instances differ on the sub-market and sub-sector degree. Nevertheless, bettering circumstances for the very best areas and areas throughout many main markets will present appreciable alternatives for buyers and builders (see under for some particular areas of anticipated enchancment in fundamentals in 2025). These similar circumstances might require extra proactive planning by company occupiers, however we anticipate the flight to high quality and portfolio optimization tendencies to proceed. Those that perceive the extremely nuanced market dynamics and leverage first-mover benefit will be capable of reap the rewards and create worth within the subsequent actual property cycle.

About JLL

For over 200 years, JLL (NYSE: JLL), a number one world business actual property and funding administration firm, has helped purchasers purchase, construct, occupy, handle and spend money on a wide range of business, industrial, lodge, residential and retail properties. A Fortune 500® firm with annual income of $20.8 billion and operations in over 80 international locations all over the world, our greater than 111,000 workers deliver the ability of a worldwide platform mixed with native experience. Pushed by our goal to form the way forward for actual property for a greater world, we assist our purchasers, folks and communities SEE A BRIGHTER WAYSM. JLL is the model identify, and a registered trademark, of Jones Lang LaSalle Integrated. For additional data, go to jll.com.

View supply