- First-quarter funding volumes surged to the very best ranges since 2019, reaching roughly £1.7B in Q1 2024

- Two giant portfolio trades at the start of the 12 months accounted for 60% of quantity

- Lodge efficiency is buoyant with in a single day stays in motels projected to surpass 2019 ranges in 2024

Roughly £1.7bn of UK actual property was transacted by lodge traders within the first quarter of 2024, in keeping with new information from actual property advisory agency Cushman & Wakefield. This represented a surge in exercise to the tune of 138% versus Q1 2023.

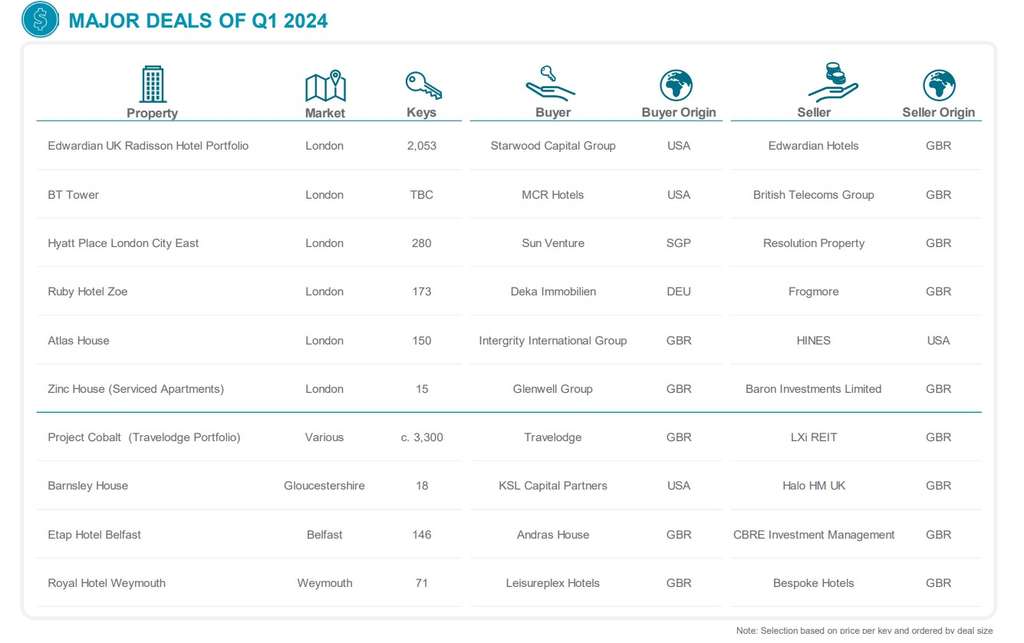

The Q1 2024 quantity coated 93 properties throughout the UK, representing c. 7,600 rooms. Two main portfolio offers, the Edwardian UK Radisson Lodge Portfolio and the LXi REIT Travelodge Portfolio comprised 60% of transaction quantity.

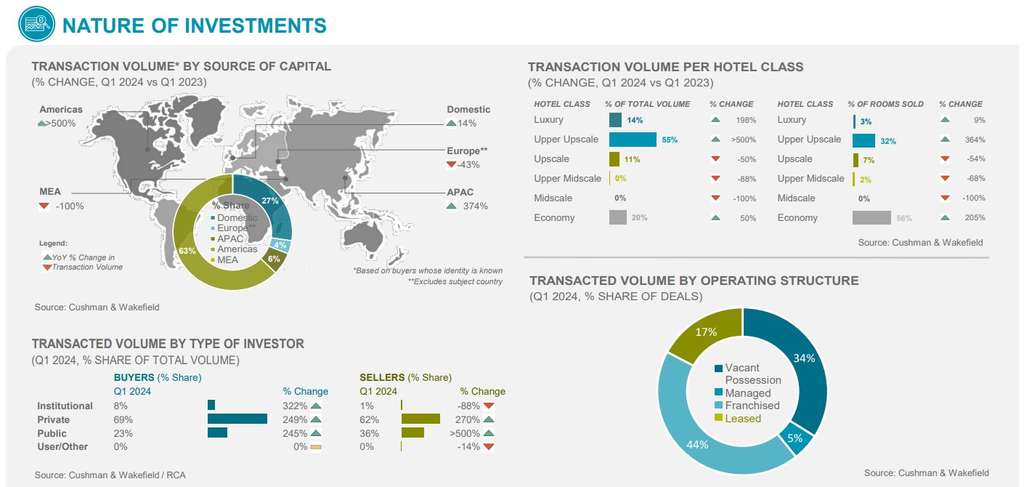

By way of capital deployed, non-public patrons had been the dominant power in offers accomplished at 69%, adopted by public traders (23%), and institutional-backed capital (8%) slowly reinvigorating curiosity within the sector.

Throughout the quarter, London accounted for 60% of main offers by quantity. This additionally included the sale of Atlas Home to Integrity Worldwide Group and the enduring BT Tower to MCR Resorts – underscoring sustained curiosity in growth initiatives that target office-to-hotel conversions, which proceed to contribute a major proportion of deal move.

However purchaser hopes, restricted misery is clear out there buoyed by sustained lodge efficiency and lender help for the sector.

Wanting ahead, the market factors in the direction of a sustained optimistic sentiment for the sector bolstered by improved client confidence, alongside the projection that leisure demand for lodge nights within the UK will develop an additional 6% this 12 months.

Nonetheless, whereas lodge provide development is anticipated to persist, it’s anticipated to proceed at a decelerated charge relative to the previous two years. UK-wide room provide grew 0.2% for the reason that starting of the 12 months with c. 24,000 rooms nonetheless below development (3.4% of stock).

A slowdown in new-build development will be attributed to elevated prices of supplies, labour, and financing. Consequently, conversion exercise is anticipated to be a main driver of lodge pipeline development within the upcoming months, particularly in key cities.

Ed Fitch, Head of Hospitality UK & Eire at Cushman & Wakefield, stated: “The final 18 months have seen the UK maintain elevated ranges of lodge efficiency, which now seems to be stabilising as the brand new normal. The bid:ask unfold continues to slowly slender. There’s sturdy capital curiosity within the sector, but deal move stays constrained by an absence of product available on the market while patrons are adopting a wait-and-see method anticipating base charge cuts in H2 2024, towards the backdrop of an impending UK election.

“From a yield perspective, we see that they continue to be secure towards these established on the shut of 2023. Towards the again finish of the 12 months, a sluggish and regular sharpening according to the gradual discount in base charges will be anticipated, though reversion to historic lows of the 2010s is unlikely.

“The enduring ‘flight to high quality’ continues to dominate the UK lodge funding, with 69% of deal move amongst luxurious and higher upscale lodge courses. This serves to intensify competitors for alternatives in prime areas and keep a persistently stringent yield surroundings for premium belongings.”

View supply