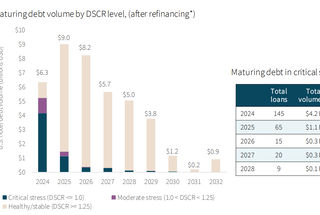

$5.8 billion of U.S. lodge single-asset securitized loans, together with CMBS and CRE CLOs are coming due for maturity in 2024. Regardless of the U.S. lodge trade demonstrating sturdy RevPAR efficiency, there are a number of headwinds that might impede the refinancing of those securitized loans and compel homeowners to transact as an alternative. These headwinds embody the lagging profitability of U.S. inns, persistently excessive rates of interest, and traditionally excessive prices of property insurance coverage.

As such, if the looming $5.8 billion “wall of maturities” in 2024 had been to be refinanced at at the moment’s rates of interest, then a big $4.2 billion of the entire quantity can be below essential stress, evidenced by a debt service protection ratio falling at or under 1.0. This represents 71.4% of whole maturing debt quantity in 2024 that will not generate adequate internet working revenue to cowl debt service. With the quantity of maturing debt in essential stress anticipated to say no over the subsequent few years, the chance to spend money on the dislocation is now.

Count on these mortgage maturities to predominantly catalyze transactions in high gateway markets as they observe the very best focus of debt in moderate-to-critical stress if refinanced at maturity in 2024.

Obtain the complete report