Historic Overview

Dubai’s actual property panorama has reworked considerably since 2010 attributable to financial diversification, infrastructure improvement, and progressive reforms. Pre-2010, extreme hypothesis and international funding fueled a property growth marked by lavish tasks just like the Palm Islands. Nonetheless, the 2008 disaster led costs to halve.

This sparked main coverage modifications to allow sustainable market progress. Relaxed possession legal guidelines, clear processes and elevated lending revived international curiosity post-2010 as provide points eased. Key tasks like Dubai Opera and the 2020 Expo additionally positioned Dubai as a pretty world hub.

Regardless of periodic shocks, proactive planning and world-class infrastructure have now made Dubai’s market resilient, investor-friendly and targeted on sustainable growth.

Present Traits

Dubai’s actual property market is predicted to proceed to rise, nonetheless at a slower charge than in 2022. Consultants count on value hikes of round 4.5% and three% in 2024 and 2025, respectively in line with Actual Property Market Traits 2023 by Dubai Housing.

In keeping with X Actuality, home gross sales are more likely to rise additional, with a bigger demand for prepared residences than off-plan. Residences, particularly smaller residences with one or two bedrooms, stay widespread. Dubai’s red-hot actual property market owes its success to business-boosting insurance policies and a major world place. zero taxes, 100% possession, hassle-free firm registration, good rental returns, and excessive annual appreciation attracts traders in.

Visa incentives permit households to reside long-term, including life-style attract for patrons. With its secure authorities and forward-thinking cityscape, Dubai has develop into the actual property hotspot within the Center East.

Residential Property Sorts With Costs & Areas

Opposite to widespread notion, Dubai’s actual property is greater than skyscrapers. The town gives an assortment of residential property sorts – from luxurious villas to high-rise residences, catering to totally different courses of traders. Right here, we offer an in-depth evaluation of those choices.

● Residences

These are the commonest property sorts, starting from small studios to spacious 3+ bed room items. Usually situated in highrise towers throughout city neighbourhoods, they provide comfort, shared facilities like gyms and swimming pools, and extra inexpensive pricing per sq. foot in comparison with homes. Under are the highest areas with ROI & costs for a studio and 1 bed room house on the market in Dubai in line with Bayut’s 2023 market report:

● Villas

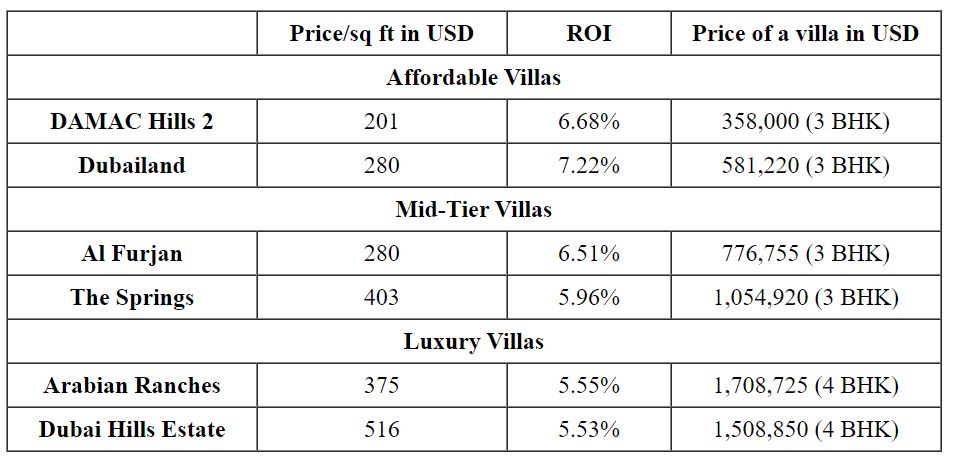

Villas present the final word in privateness, luxurious and area as single-family indifferent houses. With 4 or extra bedrooms, non-public gardens and swimming pools, and premium finishes, they’re located in unique villa communities exterior the town centre. Under are the highest areas with ROI & costs for inexpensive to luxurious villas in Dubai in line with Bayut’s 2023 market report:

● Penthouses

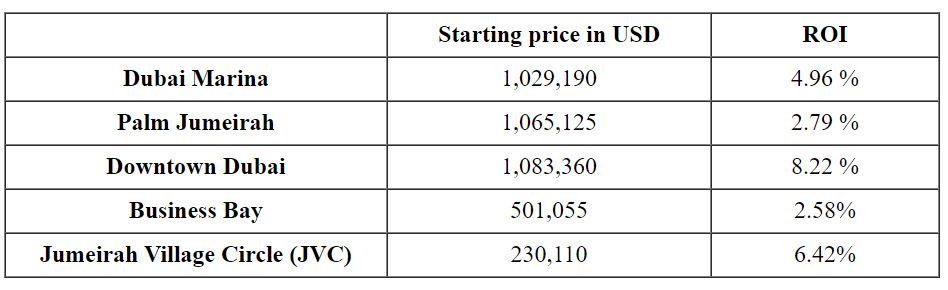

Penthouses characterize unique apartment-style residing on the highest flooring of highrises. With spectacular views, non-public elevators, swimming pools, gardens and different luxurious facilities, they cater to the ultra-wealthy in search of a fancy life-style in areas like Dubai Marina, Palm Jumeirah and others. In keeping with Bayut, the highest areas to purchase Penthouses with beginning costs in Dubai:

● Townhouses

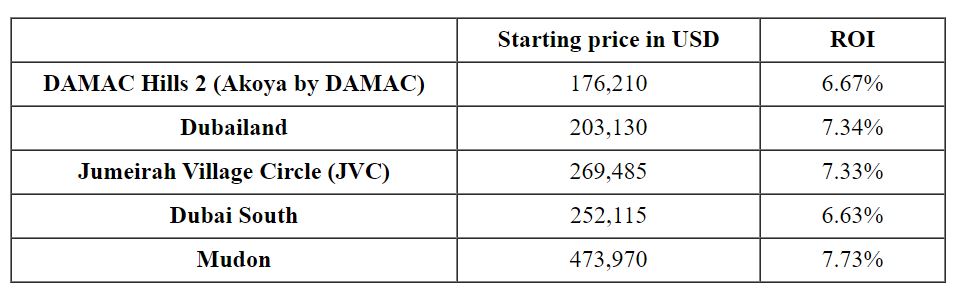

They provide a center floor – connected 2-3 storey items that share frequent partitions however have their very own entrances. Clustered collectively in communities, they supply extra space than residences for rising households in search of area at decrease costs. In keeping with Bayut, the highest areas to purchase Townhouses with beginning costs in Dubai.

The variety caters to various wants and budgets – from luxurious exclusivity to handy, inexpensive neighborhood residing inside vibrant neighbourhoods.

Progress Prospects

Given optimistic fundamentals, Dubai actual property seems primed for sustainable progress within the coming years, providing alternatives to savvy traders getting into at present valuations.

● Value Progress

After rising by 15.9% within the yr main as much as September 2023, home costs in Palm Jumeirah, Emirates Hills, and Jumeirah Bay Island—Dubai’s three “prime” residential areas—are projected by Knight Frank to rise by a extra average 5% in 2024. These non-luxury neighbourhoods had a 19% year-to-date enhance in residence costs until September 2023 and are projected to have a 3.5% progress in 2024.

● Off-Plan Initiatives

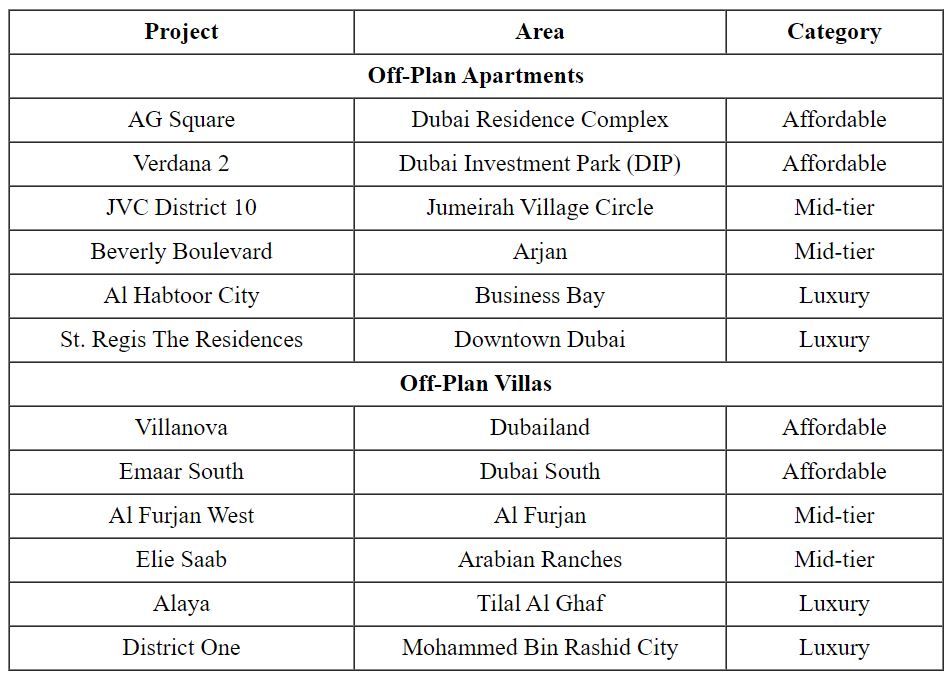

Off-plan properties contain shopping for whereas underneath building – they provide traders reductions of 20-25% in comparison with accomplished items however require cautious due diligence on undertaking supply dangers. Funds are made in instalments and patrons can customise interiors and resell upon completion for enticing income attributable to value appreciation over the development interval. A number of the high areas for off-plan properties in Dubai in line with the 2023 market report by Bayut:

● Financial Outlook

Underpinned by a diversified, business-friendly economic system forecast to develop over 3% yearly, Dubai will proceed attracting international professionals. Coupled with elements like tax incentives and low crime, the increasing center class workforce will gas actual property demand.

Conclusion

Dubai’s actual property has reworked from oil dependence to attracting world traders, cooled after 2019 however the Expo 2020 in 2021 reenergized progress. Latest sustainable developments and swelling demand now reward affected person, knowledgeable residential traders who look past prime areas to excessive potential rising areas whereas tightening rules mandate due diligence.