Funding Traits

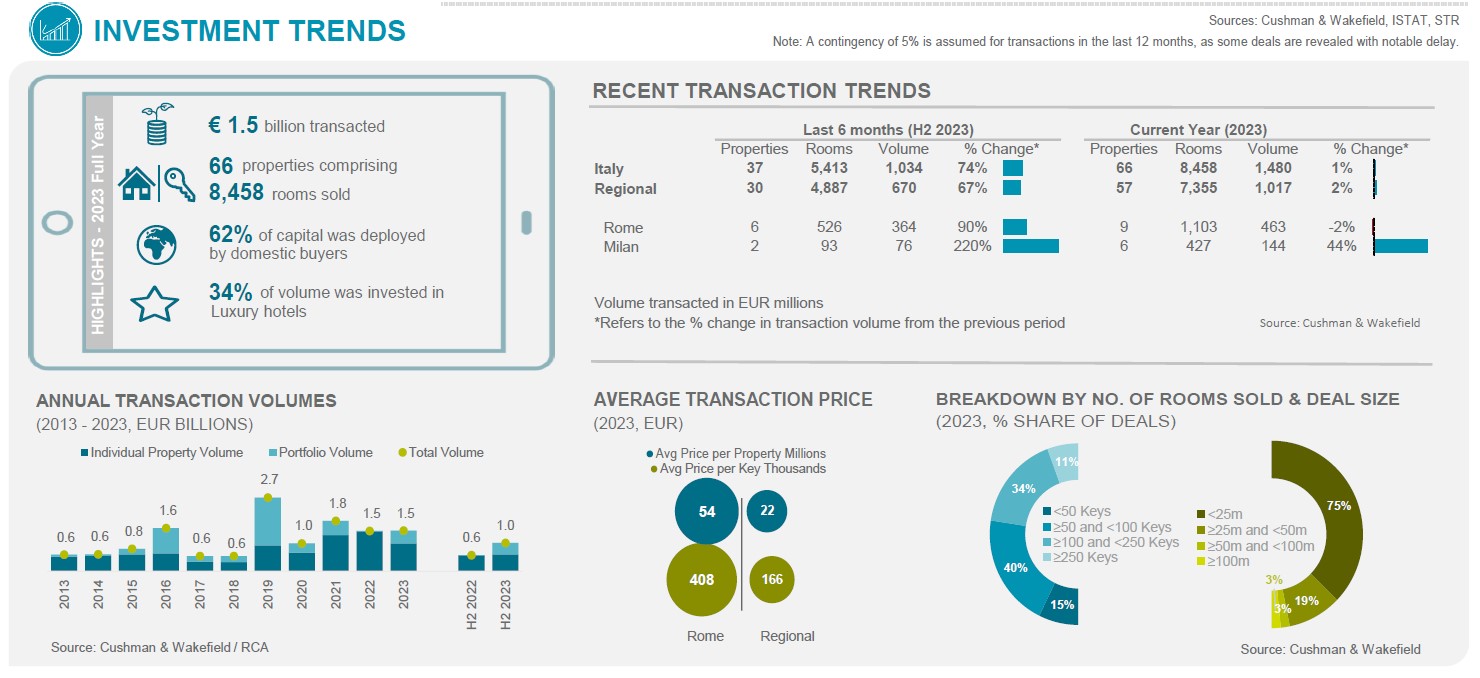

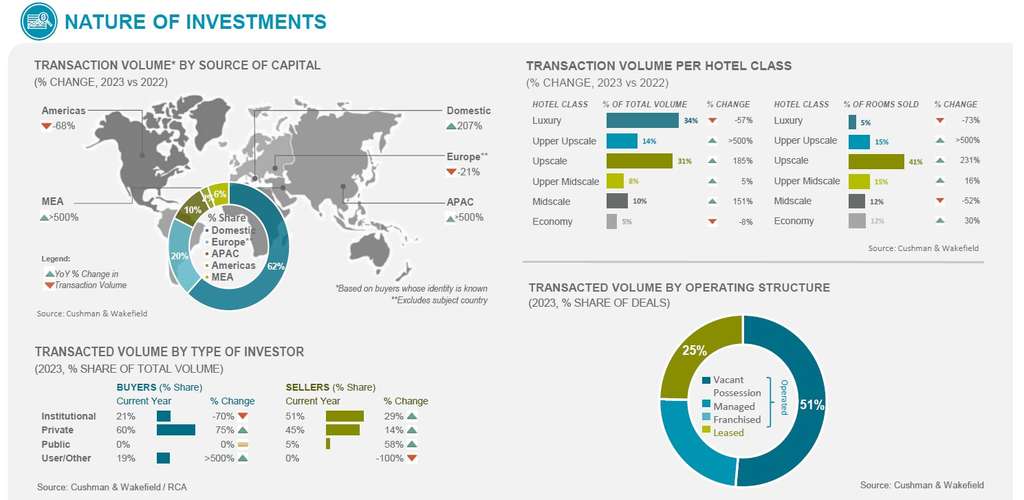

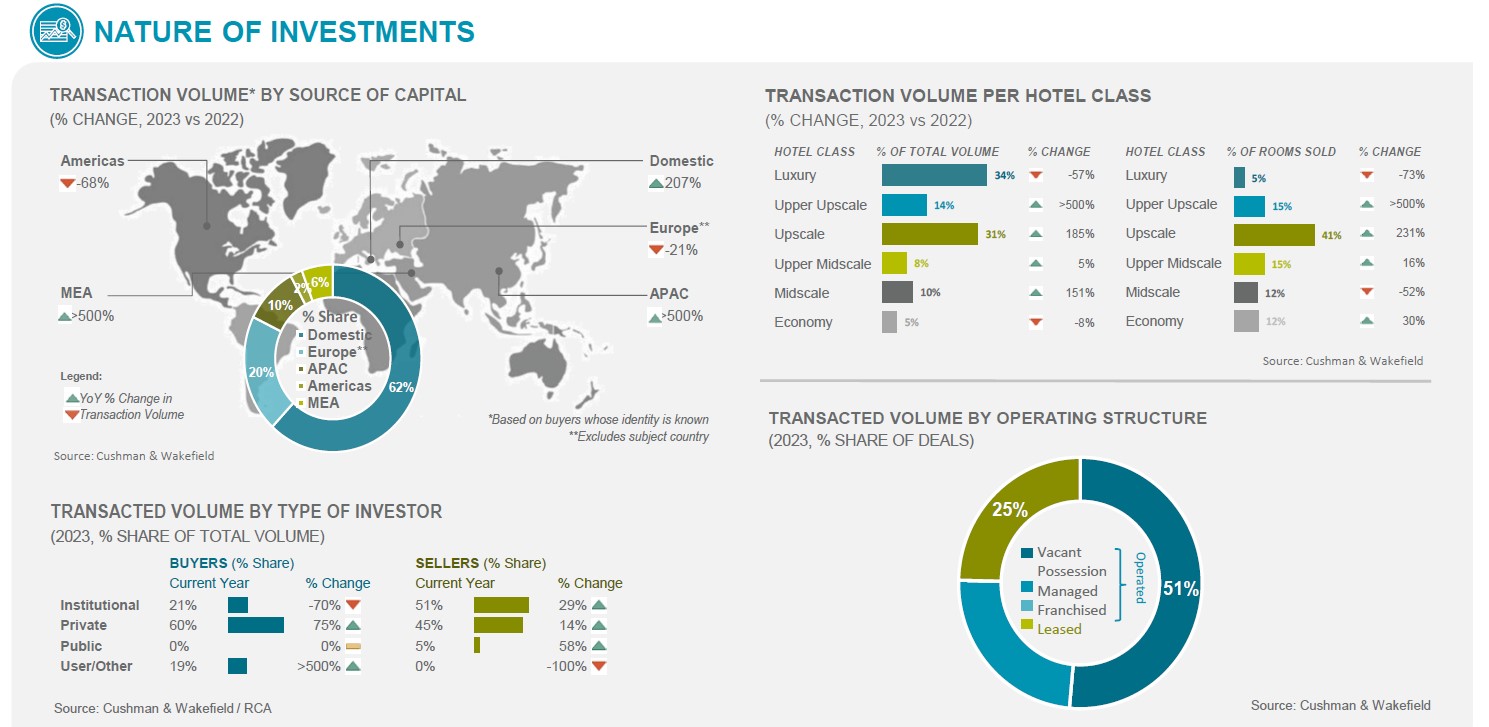

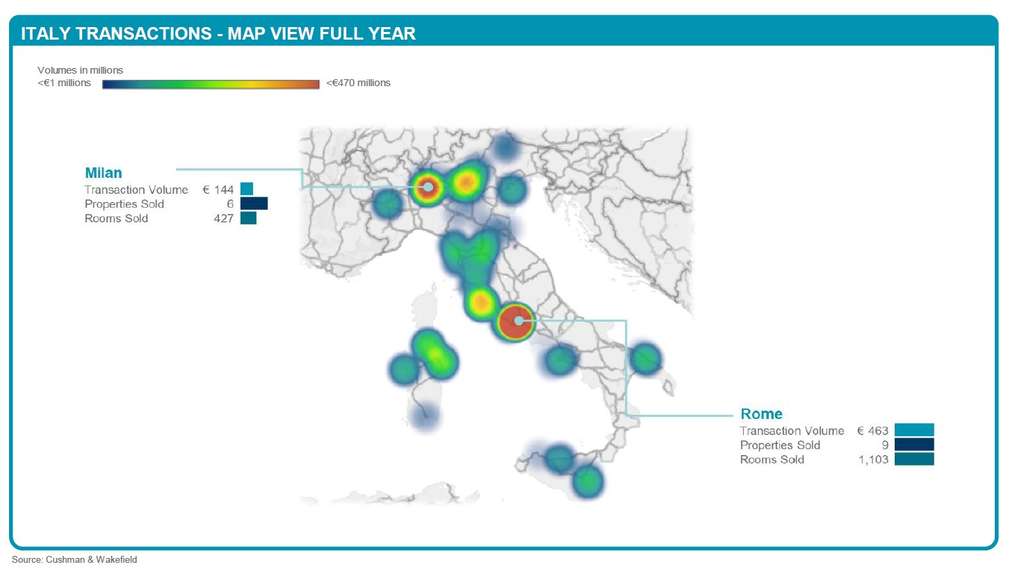

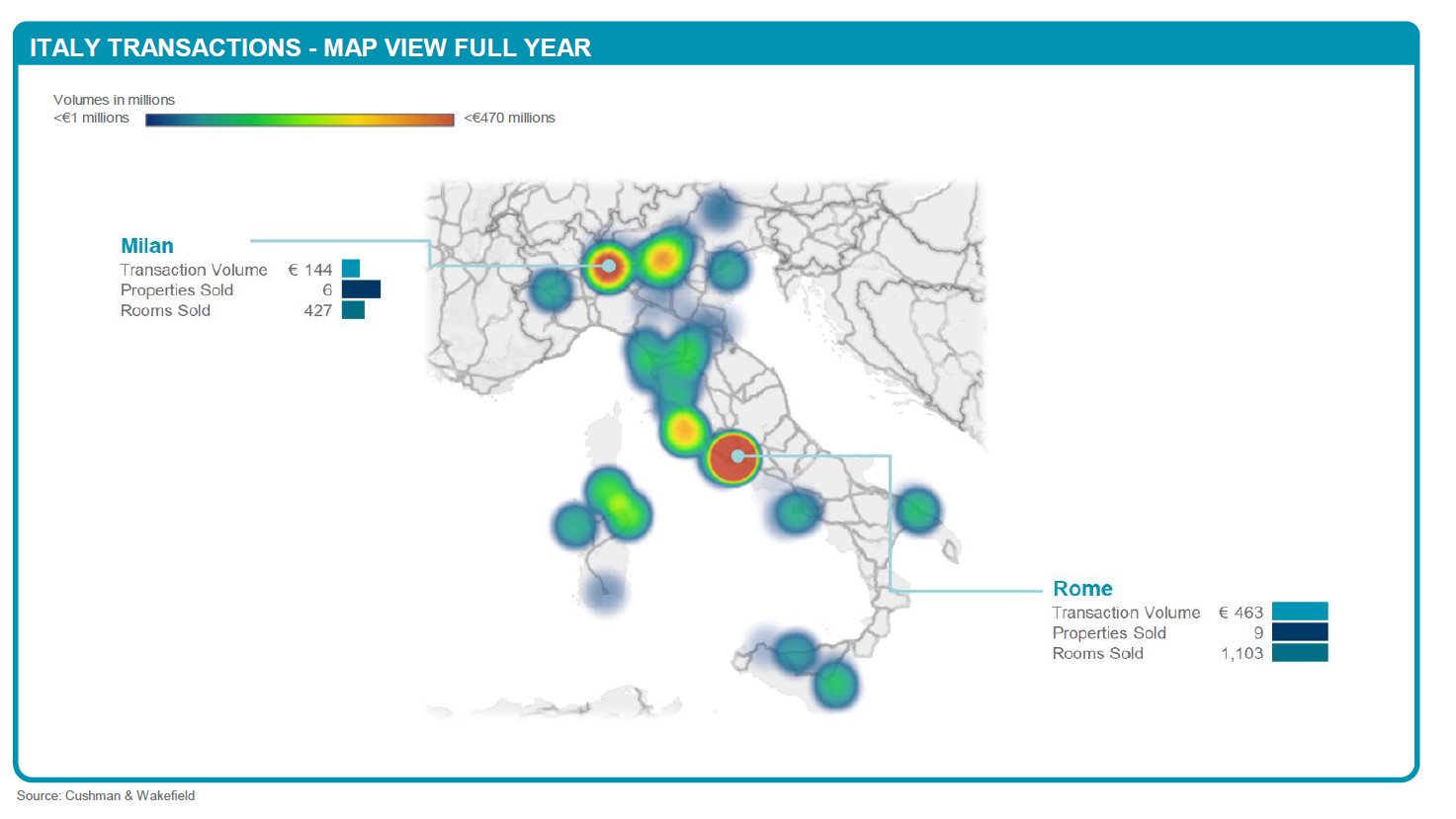

Following a sluggish begin, lodge funding exercise surged within the second half of 2023, exceeding €1 Bn (+74% vs H2 2022). Whole funding volumes for 2023 amounted to €1.5 billion (+1% vs 2022), reaffirming hospitality as a number one sector within the Italian actual property market. Key transactions included the acquisitions of Six Senses Rome, Aermont Pellicano Portfolio, and the sale of Blackstone’s 35% stake in HIP.

Prime Yields

Whereas transactions picked up within the latter half of the yr, the yields continued to decompress, reflecting the tight lending circumstances. This development is anticipated to persist for lower-quality property within the close to time period, whereas high-quality property are anticipated to carry worth, particularly within the luxurious sector.

Market Efficiency

In 2023, the Italian lodge sector recorded one of many highest performances in Europe (top-3), and skilled the second strongest progress relative to 2019 (+44%). This was primarily pushed by a robust enhance in ADR (+46%), whereas occupancy stands 1% under 2019 ranges. Amongst European key markets, Rome skilled the quickest RevPAR progress (+55% vs 2019). Wanting forward, we count on average RevPAR progress in 2024.

Provide Outlook

H2 2023 was marked by quite a few new openings of 5-star inns, primarily located in Italy’s prime 4 vacationer locations. Probably the most notable was the Palazzo Cordusio, a Gran Meliá Lodge (84 keys) in Milan, whereas a substancial enlargement occured in the important thing Italian mountain and lake vacationer locations. In 2024, over 55 inns are anticipated to open throughout Italy, though in Rome and Milan the availability progress will stay under 2%.

Demand Outlook

Italy’s tourism sector demonstrated a sustained demand restoration all through 2023, with home vacationers and worldwide guests producing an estimated 154 million in a single day stays (+12% on 2022) and 120 million in a single day stays (+18% on 2022), respectively. In 2024, enhance in worldwide journey would be the key driver of progress, with mounting curiosity in Italy’s main leisure sea, mountain and lake locations.

View supply