U.S. financial development slowed throughout 1Q-2024 with Actual GDP rising 1.6%, effectively under 4Q-2023 development of three.4%. Regardless of optimistic financial development, U.S. RevPAR solely elevated 0.2%, as each demand and occupancy declined for the fourth consecutive quarter. January and February RevPAR elevated by1.0% and a couple of.4% respectively, whereas March decreased 2.2%, largely tied to the Easter calendar shift. Whereas this quarter’s RevPAR development was negatively impacted by the Easter calendar shift by roughly 100 bps, the second quarter ought to expertise the same tailwind.

Transferring ahead, Moody’s Analytics expects Actual GDP development to extend 2.5% in 2024, and whereas development will speed up from the low 1Q-2024 degree, it could show to be extra risky than beforehand anticipated. On a optimistic word, financial development appears to be the consensus. As of April, solely 29% of economists surveyed by the Wall Avenue Journal count on a recession to materialize throughout the subsequent twelve months (the bottom degree since April 2022). Nevertheless, indicators of a softening client proceed to mount, which is discouraging heading into the leisure-centric summer season journey season. April retail gross sales disillusioned, with no development. Moreover, the April Visa Spending Index dropped 5%, with Visa’s Discretionary Spending Index declining 4% within the month. This was the sharpest month-to-month decline of both metric since early 2022. In the meantime headline inflation rose 3.4% in April, in keeping with expectations, however nonetheless well-above the Fed’s goal, limiting the probability of any near-term rate of interest cuts which may stimulate financial development.

Along with these challenges, an unsure U.S. presidential election could lead on shoppers and companies alike to curtail spending in 2024. In truth, since 2000, presidential election years have seen Actual GDP development decline by 110 bps on common vs. the prior 12 months. In every of the previous 4 presidential election years, each demand development and RevPAR development slowed from the prior 12 months. As such, regardless of our baseline view of no near-term U.S. recession, our outlook for the lodging {industry} stays considerably cautious.

In 2024, lodging {industry} development shall be fueled by company transient, group, and inbound international journey whereas home leisure demand continues to wane. Group developments stay strong, serving to generate a base degree of demand that can additional help pricing energy. Nationally, we estimate that the conference middle reserving tempo is up 4% on a year-over-year foundation in 2024, following the 15% enhance in 2023. Nevertheless, the reserving tempo is down 3% in 2025, so there’s threat of modest group headwinds subsequent 12 months. Company transient demand developments are modestly optimistic, supported by rising company income, inventory costs and restricted (very restricted in some markets) enhancements in workplace utilization.

Moreover, international inbound journey to the U.S. was nonetheless 16% under 2019 ranges in 2023, offering a chance for ample restoration in 2024. In truth, momentum in international inbound journey remained robust in early 2024, with YTDApril ranges simply 9% under 2019 ranges and up 15% yearover 12 months. Sadly, developments in U.S. outbound worldwide journey additionally stay robust, with YTD-April ranges 20% above 2019 ranges and up 11% year-overyear. As such, whereas U.S. outbound worldwide journey comparisons shall be a lot simpler as we progress by means of 2024, developments aren’t encouraging.

Worldwide Journey Progress Charges vs. 2019 Ranges

It is very important word that not each market will profit from international inbound journey restoration. Not even each gateway-oriented market will profit. Each market has skilled a special degree of restoration of international journey and understanding these nuanced particulars is crucial to understanding which markets could have tailwinds from inbound international journey and which of them is not going to.

Moody’s Analytics financial forecast incorporates the next key nationwide assumptions that drive our outlook:

- The Fed has paused price will increase till cuts start in September and drop 25 bps per quarter into 2027.

- U.S. GDP will enhance 2.3% in 2Q-2024 and a couple of.5% in 2024.

With that backdrop, our present 2024 RevPAR outlook moderates to 1.8% year-over-year development, fueled by a 2.6% enhance in ADR and a 0.8% lower in occupancy. The excellent news is that we count on 1Q-2024 to be the softest quarter of the 12 months. Because the calendar anniversaries the demand declines that started in 2Q-2023, and the nation experiences some modest tailwinds from the Easter calendar shift, 2Q-2024 would be the strongest quarter of the 12 months.

Nevertheless, ought to any of the above core macroeconomic assumptions meaningfully change, it may have a considerable impression on our U.S. lodging {industry} forecast.

We proceed to count on there to be U.S. lodging markets that materially outperform in addition to those who underperform nationwide averages. Typically, we count on markets with outsized publicity to company transient, group, and inbound international journey restoration to be the outperformers, whereas markets with the best publicity to home leisure demand and people underperforming from a gaggle tempo perspective to be the laggards.

Moreover, we anticipate financing prices to stabilize and transaction volumes to rebound. Expense pressures will grow to be a considerable consider figuring out markets which can be winners and people which can be losers, particularly with a number of main cities embarking on new union negotiations within the coming years. Wage and expense development and their pressure on margin development materially shapes our views on markets which can be greatest and worst for funding at the moment.

Transparency surrounding forecasting is crucial to the lodging {industry}. We consider the perfect enterprise selections are based mostly on the best high quality information and knowledge accessible on the time of creating such conclusion(s). We take that method with our forecasts, utilizing the perfect and most related accessible info to supply the more than likely outcomes.

LARC’s industry-leading market intelligence is out there to assist all {industry} members navigate the present setting and place themselves for achievement. Please contact us to study extra about our companies and merchandise, or if there’s some other method we could possibly serve you.

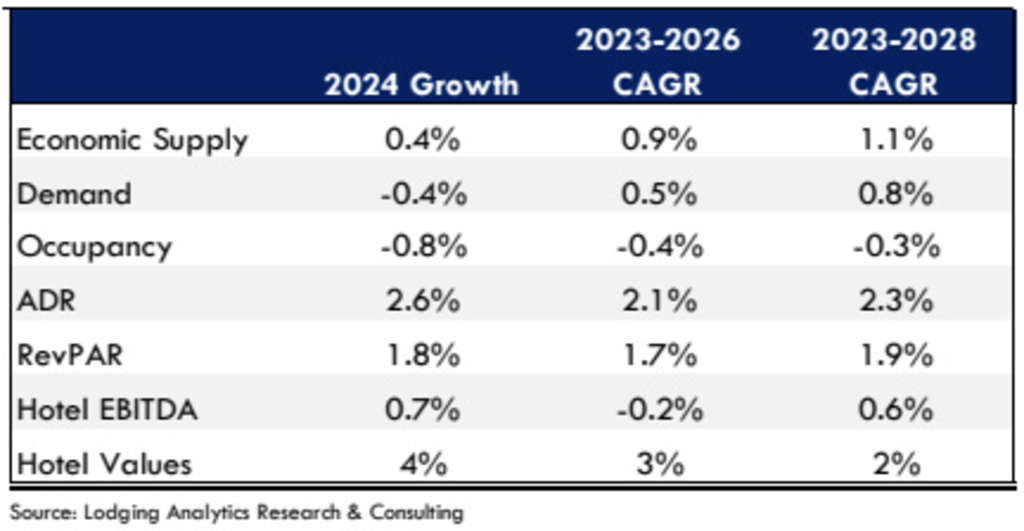

LARC’s Business Outlook

At the moment, Lodging Analytics Analysis & Consulting (LARC) expects U.S. RevPAR to extend by 1.8% to $99.88 in 2024, pushed by ADR development of two.6% to $159.92 whereas occupancy declines 0.8% to 62.5%.

LARC forecasts 2024 U.S. Lodge EBITDA to develop 0.7%, with slight margin erosion, and Lodge Values to extend 4%. Over the following 5 years, LARC expects Lodge Values to extend 11%.

June 2024 U.S. Lodge Business Forecast Abstract

LARC’s U.S. RevPAR mannequin has an R-squared of 98.7% with an ordinary error of two.7%, back-tested to 2000. LARC’s U.S. Cap Price mannequin has an R-squared of 98.5% with an ordinary error of 26 bps, back-tested to 2005.

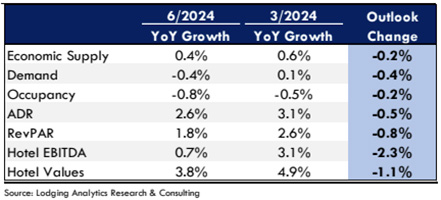

2024 U.S. Lodge Business Forecast: June 2024 Version vs. March 2024 Version

The above desk illustrates a abstract of LARC’s present U.S. Lodge Business Outlook in distinction to final quarter’s outlook. Observe that the overwhelming majority of our outlook change was pushed by softer 1Q-2024 outcomes than anticipated. The rest of the 12 months is minimally modified, with RevPAR development averaging about 2.5% for the final three quarters of the 12 months, which is in keeping with the prior forecast outlook. In the end, our 2024 view for provide and demand each moderated, driving our occupancy forecast decrease. Our outlook for ADR barely declined, which mixed with our diminished occupancy development outlook, drives a 0.8% lower to our 2024 RevPAR outlook. The highest-line unfavorable revision interprets to a discount in our Lodge EBTDA outlook, which in flip reduces our outlook for Lodge Worth forecast.

Market Outlooks

Listed under are the perfect and worst performing markets based mostly on our forecasts. Just like LARC’s U.S. forecast, our market degree forecasts are structured on multi-variable regression fashions with a excessive degree of historic accuracy.

Extra element relating to our market outlooks may be present in LARC’s Market Intelligence Stories. Please contact us in case you are desirous about buying any of LARC’s choices.

2024

Prime Markets for RevPAR Progress:

San Jose, Philadelphia, Seattle, Honolulu & Minneapolis

Backside Markets for RevPAR Progress:

St. Petersburg, Kauai, Omaha, Los Angeles & Denver

5-Yr Outlook

Prime Markets for RevPAR Progress:

Maui, Raleigh, Portland (OR), Cellular & Honolulu

Backside Markets for RevPAR Progress:

Cincinnati, Omaha, Kansas Metropolis, Indianapolis & Austin

Prime Markets for Worth Change:

Puerto Rico, Las Vegas, Seattle, Orlando & San Francisco

Backside Markets for Worth Change:

Chicago, Boston, San Diego, Austin, & St. Louis

Ryan Meliker

President

Lodging Analytics Analysis & Consulting, Inc